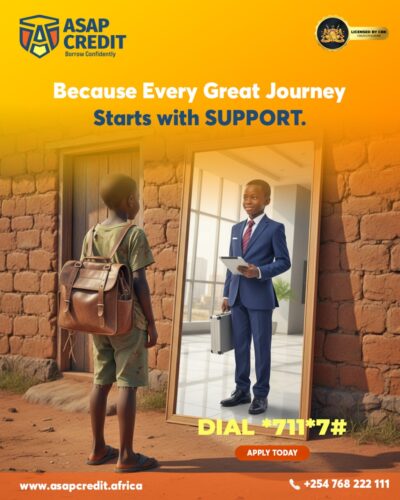

Unlock Your Paycheck Power WithSEAMLESS LOANS

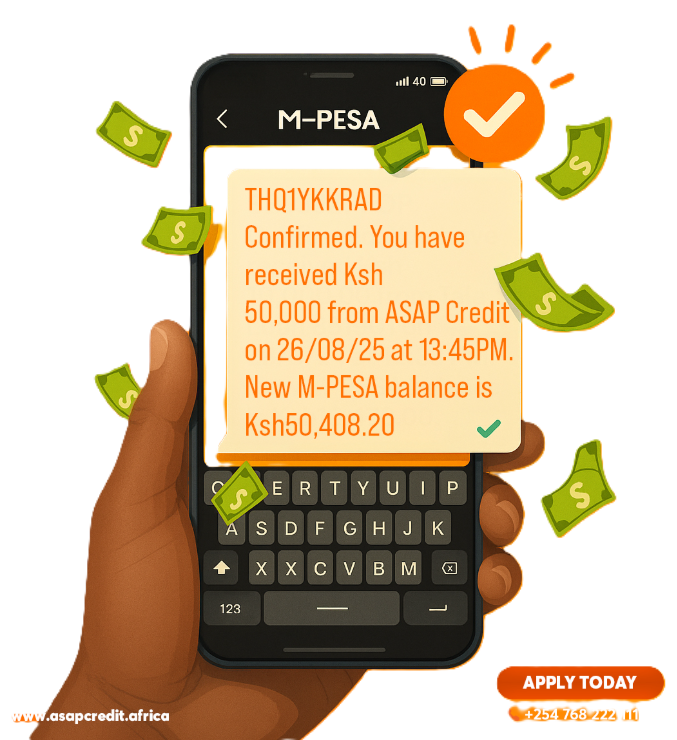

Asap Credit's Check-Off Loans provide quick, unsecured financial relief for salaried employees through simple employer partnerships. Access up to 50% of your net pay in minutes – no paperwork, no CRB checks, no hidden fees. Available 24/7 via our app or USSD, with flexible 1-3 month terms at just 10% interest. Borrow confidently with CBK-licensed solutions tailored for you and your team.

Dial Now For Loan

_OUR PROCESS

Our Products

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form,

CHECKOFF LOANS

This is a short-term salary advance facility available to the salaried whose employer has a memorandum of understanding (MOU) with Asap Credit Limited (ACL) . This facility is meant to meet the customers' short term financial needs such as emergencies deductible on the next pay day.

Borrow confidently on Asap Credit

BENEFITS TO EMPLOYER

Motivated employees are able to perform better, and ACL helps businesses maintain smooth cashflow within operations. By taking charge of salary advances, ACL improves efficiency and supports financial management discipline among employees. The service is easily accessible via mobile app and USSD, available 24/7, with flexible and convenient repayment options tailored to meet employee needs.

BENEFITS TO EMPLOYEES

Convenience is guaranteed since no paperwork is needed, no CRB checks, no deposits or savings, and the application process is easy. You can also top up on an existing salary advance up to the maximum limit. There are no hidden charges, and the service is quick and easily accessible 24/7. In addition, there are no charges for not using the facility, and no security is required to apply for the loan. The service becomes accessible immediately after registration is complete, with flexible repayment options available.

Boda Boda and Tuk Tuk Loans

Get quick, affordable loans for your Boda Boda or Tuk Tuk with flexible repayment plans designed to boost your business and keep you moving forward.

Cheque Discounting

Instantly boost your cash flow by converting post-dated cheques into quick, hassle-free cash with our secure cheque discounting service.

LPO Financing

Grow your business confidently with our LPO Financing, covering supplier costs so you can fulfill large orders without cash flow worries.

Title Deed Loans

Secure a flexible loan using your property’s title deed as collateral, with fast approval and affordable repayment terms to meet your financial needs.

Vote of Confidence

_WHY ASAP CREDIT ?

REQUIREMENTS

- 1. MOU with Employer

- 2. Existing Employment Contract

- 3. National ID

- 4. Phone

- 5. Payslip

- 6. Approval by HR

CHECKOFF LOANS

This is a short-term salary advance facility available to the salaried whose employer has a memorandum of understanding (MOU) with Asap Credit Limited (ACL) . This facility is meant to meet the customers' short term financial needs such as emergencies deductible on the next pay day.

Get started now

Benefit to Employer

Motivated employees are able to perform better, and ACL helps businesses maintain smooth cashflow within operations. By taking charge of salary advances, ACL improves efficiency and supports financial management discipline among employees. The service is easily accessible via mobile app and USSD, available 24/7, with flexible and convenient repayment options tailored to meet employee needs.

Get started now

Benefits to Employees

Convenience is guaranteed since no paperwork is needed, no CRB checks, no deposits or savings, and the application process is easy. You can also top up on an existing salary advance up to the maximum limit. There are no hidden charges, and the service is quick and easily accessible 24/7. In addition, there are no charges for not using the facility, and no security is required to apply for the loan. The service becomes accessible immediately after registration is complete, with flexible repayment options available.

Get started now

Requirements

MOU with Employer, Existing Employment Contract, National ID, Phone, Payslip, Approval by HR

Get started now

_FAQ

Product Features

Loan Amount

Min Limit: Kshs 2,000

Max Limit: Kshs 100,000 or as defined in the MOU with the employer (up to 50% of net pay)

Loan Term

1-3 month maximum

Pricing

Through USSD or Mobile App

Interest rate: 10% p.m

Processing Fee: 2%

Application

Through USSD

Loan Security/ Collateral

Have more question ?

_SERVICE COMPARISONS

Empower Your Paycheck With Instant Cash Solutions

Unlock fast, unsecured loans tailored for salaried workers and businesses. Get up to KES 1M in minutes with no CRB checks, no collateral, and flexible 1-48 month terms at 3.34% starting rates. Available 24/7 via USSD or app—your financial freedom starts now!

Other Companies

Instant Approval Process

Loans approved in seconds via app or USSD, enabling immediate fund access.

24-48 hours with data checks

Ultra-Low Starting Interest Rates (3.34%)

Rates from 3.34% per month, with 10% p.m. for check-off loans and no hidden fees.

15-30% APR (~5-10% monthly); traditional banks: 12-18%—Asap saves 50-70% on interest.

No CRB Credit Checks Required

Approval based on basic eligibility (e.g., salary via employer MOU), no credit bureau checks.

Pull CRB reports, reject 40-60% of low-score applicants; traditional banks: Require clean history—Asap opens doors for first-timers.

Zero Collateral, Guarantors, or Extensive Documents

Requires only ID, payslip, and HR nod—no deeds, guarantors, or bank statements

May need device data scans or guarantees; traditional banks: Often require collateral—Asap reduces rejections by 30-50%.

24/7 Accessibility

No hidden fees or charges

_Blog

News & Updates

There are many variations of passages of Lorem Ipsum available,

but the majority have suffered alteration in some form,

How to get Instant Mobile loans Kenya

Where to Get Small Business loans in Kenya: Expert Guide

Instant Mobile Loan | Personal and Emergency Loans Kenya

ONBOARDING PROCESS

1. Employer signs the MOU with Asap Credit Limited

2. Employer provides employees’ details in a standard template provided by Asap Credit

3. Asap Credit processes the employees’ information provided in the lending system

4. Employees receive a bulk SMS on how to apply for the service via USSD or mobile app

5. Employee applies for the service via USSD or mobile app

6. Employee selects ASAP advance and applies for a loan within the defined credit limit

7. Approval is sought from the HR or Employer’s contact person. If approved, we disburse, if declined we decline

8. ACL forwards deduction sheet to the employer on payroll cut-off date to facilitate the checkoff deductions

Click *711*7# for instant check-off loans.

- Instant Access, No Hassle

- Secure & Fast Disbursement