Are you in need of quick cash in Kenya? Look no further! This article will guide you through the top 5 online loan options that can provide you with the financial assistance you need in 2024.

1. Asap Credit Africa

Asap Credit Africa is a leading online lending platform in Kenya that offers quick and convenient loan access. With a simple application process and fast approval times, you can get the cash you need in no time.

2. Personal Loans

Personal Loans is another reliable option for online loans in Kenya. They offer a range of loan products to cater to your financial needs, from personal loans to business loans. With competitive interest rates and flexible repayment terms, Personal Loans are a great choice for those seeking quick cash.

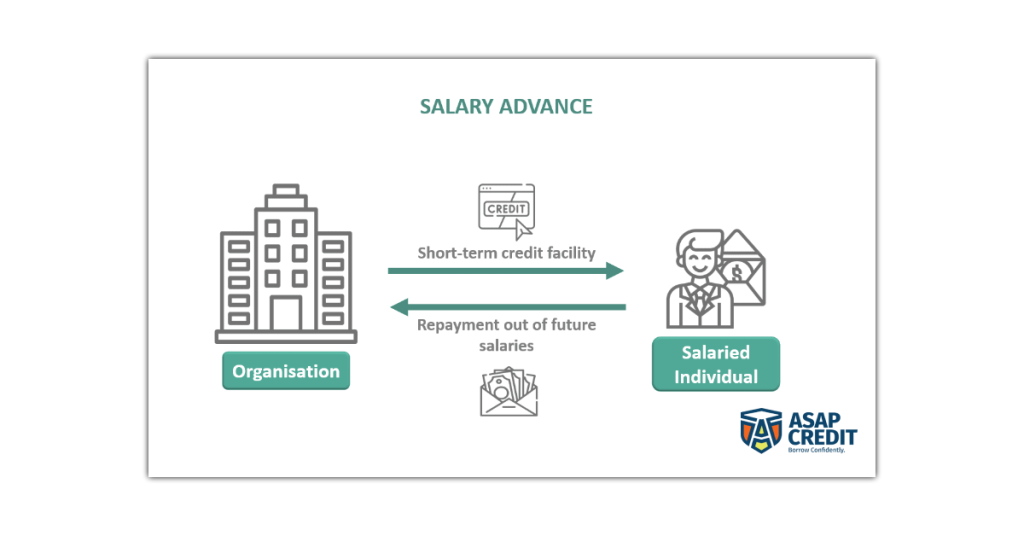

3. Salary Advance Loans

Salary Advance is a unique online loan service that allows you to access a portion of your upcoming salary in advance. This can be particularly useful for those facing unexpected expenses or financial emergencies.

4. Apply Online Loans

Apply is a user-friendly online loan form that offers a seamless application process and fast approvals. Whether you need a personal loan, a business loan, or a quick cash advance, Apply has got you covered.

5. Insurance Premium Financing

For those who need to pay their insurance premiums, Insurance Premium Financing is a great option. They provide online loans specifically designed to help you cover your insurance costs, making it easier to manage your financial obligations.

Why Choose Online Loans in Kenya?

Online loans in Kenya offer several advantages over traditional lending methods. They are convenient, accessible, and often have faster approval times, making them an ideal solution for those in need of quick cash. Additionally, many online lenders in Kenya offer competitive interest rates and flexible repayment terms, making them a viable option for a wide range of financial needs.

How to Apply for Online Loans in Kenya

Applying for online loans in Kenya is a straightforward process. Simply visit the lender’s website, fill out the application form, and provide the necessary documentation. Most lenders will review your application and provide a decision within a matter of minutes or hours.

Conclusion

If you’re in need of quick cash in Kenya, the top 5 online loan options listed above are worth considering. Whether you need a personal loan, a business loan, or a quick cash advance, these lenders can provide you with the financial assistance you need. Visit their websites or contact them at tel:+254768222111 or [email protected] to get started.