Introduction

Are you finding it hard to make ends meet before your next payday? Struggling financially can be incredibly stressful, but there is a solution that can provide you with quick relief: salary advance loans. In this blog, we’ll explore how salary advance loans work, their benefits, and how you can apply for one today to get the financial help you need.

What is a Salary Advance Loan?

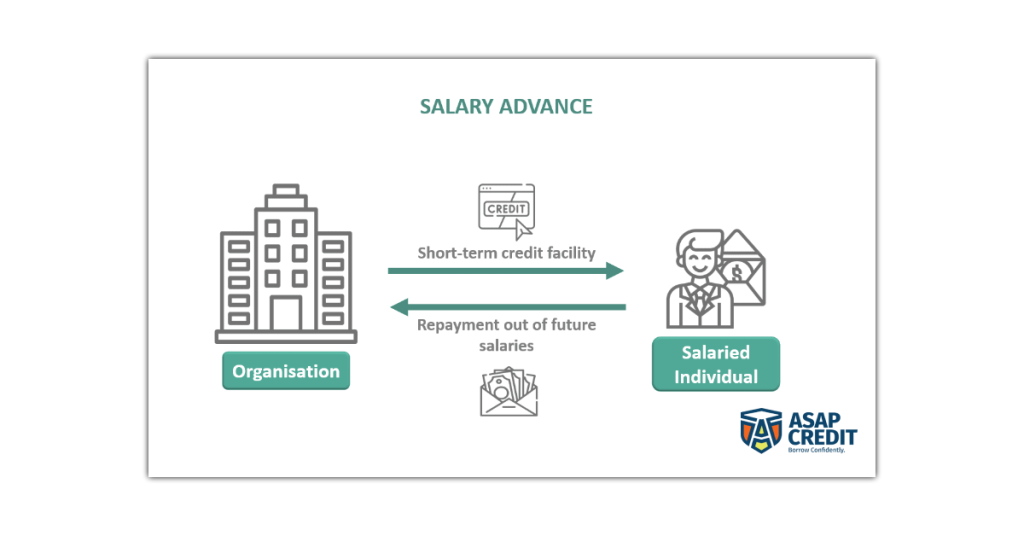

A salary advance loan is a short-term loan designed to help you cover unexpected expenses or financial shortfalls before your next paycheck arrives. Unlike traditional loans, salary advance loans are typically easier to qualify for and have a faster approval process, making them an ideal option for those who need cash quickly.

How Do Salary Advance Loans Work?

Salary advance loans work by allowing you to borrow a portion of your upcoming paycheck. The loan amount is usually a percentage of your salary, and repayment is typically deducted directly from your next paycheck. This straightforward process makes salary advance loans a convenient option for managing financial emergencies.

Benefits of Salary Advance Loans

- Quick Access to Cash: One of the primary benefits of a salary advance loan is the speed at which you can get the funds. In many cases, you can receive the money within 24 hours of applying.

- Easy Qualification: Since these loans are based on your salary, the qualification criteria are often less stringent compared to traditional loans. This makes it easier for individuals with less-than-perfect credit scores to get approved.

- No Collateral Required: Salary advance loans are typically unsecured, meaning you don’t need to provide any collateral to obtain the loan. This reduces the risk and hassle of borrowing.

- Flexible Use of Funds: The money you receive from a salary advance loan can be used for any purpose, whether it’s paying off bills, covering medical expenses, or handling unexpected repairs.

How to Apply for a Salary Advance Loan

Applying for a salary advance loan is a straightforward process. Here are the steps to get started:

- Research Lenders: Look for reputable lenders who offer salary advance loans. Make sure to read reviews and compare terms to find the best option for your needs.

- Prepare Documentation: Gather necessary documents such as proof of income, identification, and employment details. This will streamline the application process.

- Submit Your Application: Fill out the application form provided by the lender. This can usually be done online for convenience.

- Approval and Disbursement: Once your application is reviewed and approved, the loan amount will be disbursed to your bank account. This process is often completed within 24 hours.

Things to Consider Before Taking a Salary Advance Loan

While salary advance loans can be a lifesaver in times of financial stress, it’s important to consider the following before applying:

- Interest Rates and Fees: Make sure to understand the interest rates and any additional fees associated with the loan. These can vary significantly between lenders.

- Repayment Terms: Ensure you are comfortable with the repayment terms, as the loan amount will be deducted from your next paycheck. This could impact your budget for the following month.

- Alternative Options: Explore other options such as borrowing from family or friends, or negotiating payment plans with creditors, to ensure a salary advance loan is the best choice for your situation.

Conclusion

When you’re struggling financially, a salary advance loan can provide the quick cash relief you need to manage your expenses until your next paycheck. With easy qualification, fast approval, and flexible use of funds, salary advance loans are a practical solution for many. If you find yourself in a financial bind, consider applying for a salary advance loan today and regain control of your finances.